Four Strategies to Improve Your Financial Decision Making

By Zeke Anders on March 15, 2022

Written by: Zeke Anders

Financial planning involves making decisions under uncertainty. We can’t predict the future, which means we must make choices based on the information we have. The challenge is, we all have biases and blind spots that can hinder our ability to make good decisions. Daniel Kahneman wrote a book, “Thinking, Fast and Slow,” about our cognitive biases and heuristics that can lead us astray. Given our limited information and biases, how do we make better decisions? In general, we can make better choices by talking to others, automating our actions, and avoiding labels and sensational predictions.

Kahneman said that the best check against our biases is an outside opinion. Sometimes a fresh set of eyes can find an error that we didn’t notice. You may have also had the experience of asking someone for help, only to realize the solution while explaining the problem. Others may have more information or more experience than we do. Todd Simkin, a director of Susquehanna Investment Group, one of the biggest trading firms in the world, recently appeared on The Knowledge Project podcast. He explained that the most important variable to make better decisions is to talk more. By talking through our thoughts with an objective third party, we can help clarify our own thinking, uncover other perspectives, and check our biases.

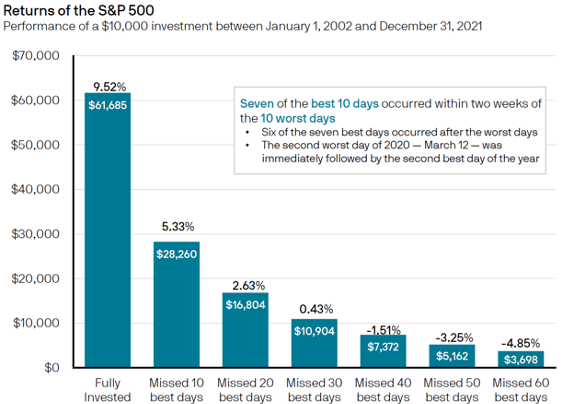

Another way to make better choices is by reducing the number of choices to make. In the same podcast, Simkin discusses how it was easier for him to work out seven days a week instead of five, since there was never a question of, “Do I work out today or not?” Along those lines, we can automate decisions such as contributing to our investment accounts or outsource decisions like rebalancing our portfolio. If we have to remember to transfer funds or wait for motivation, we will often put off taking action. When we automate or outsource these tasks, we free up that mental space for other activities. When we try to time the market, we increase the number of decisions we need to make and introduce room for error. Timing the market requires two correct decisions: when to get out and when to get back in. The consequences for getting either decision wrong are immense. Historically, a large portion of equity market returns have come from a handful of trading days. Time in the market generally beats timing the market. Making fewer decisions by automating, outsourcing, or eliminating decision points can help us make better choices and reduce our mental load.

Lastly, labels can encourage us to make decisions based on a group affiliation rather than using all the information available. Per Robert Cialdini, author of “Influence: The Psychology of Persuasion,” we typically have a desire to appear consistent to others and when we publicly make a statement or prediction, we want our public actions to be consistent with that statement. In the equities market, labels such as “value versus growth” or “bull versus bear” can influence investors to behave according to their chosen style or outlook. It is better for us to keep an open mind and observe what is happening rather than commit to one path forever.

Making decisions under uncertainty is difficult, especially when the stakes are high. Talking to a third party can give us an objective opinion and a fresh perspective, as well as to help clarify our thoughts. Reducing the number of decisions we have to make frees up our mental space, ensures that our plans are implemented, and decreases opportunities to make a poor choice. Avoiding labels and bold predictions allows us flexibility to adapt as we learn more or the situation changes. Following these principles may help us make better decisions with regards to our financial future.

Disclaimer

Hightower Advisors, LLC is an SEC registered investment adviser. Securities are offered through Hightower Securities, LLC member FINRA and SIPC. Hightower Advisors, LLC or any of its affiliates do not provide tax or legal advice. This material is not intended or written to provide and should not be relied upon or used as a substitute for tax or legal advice. Information contained herein does not consider an individual’s or entity’s specific circumstances or applicable governing law, which may vary from jurisdiction to jurisdiction and be subject to change. Clients are urged to consult their tax or legal advisor for related questions.