Whole Life Insurance as a Buffer Asset

By Macy Jae Moore on September 15, 2022

Written by: Zeke Anders

The Benefit of (Existing) Whole Life Insurance as a Buffer Asset

A common question people have is what to do with an existing whole life insurance policy once they’ve reached retirement and their circumstances have changed. Perhaps you bought the policy years ago or received it through an employer. Maybe now the mortgage is paid off and the kids have left home, and you’re wondering if it makes sense to keep the policy. One reason to keep the policy is to serve as a buffer asset.

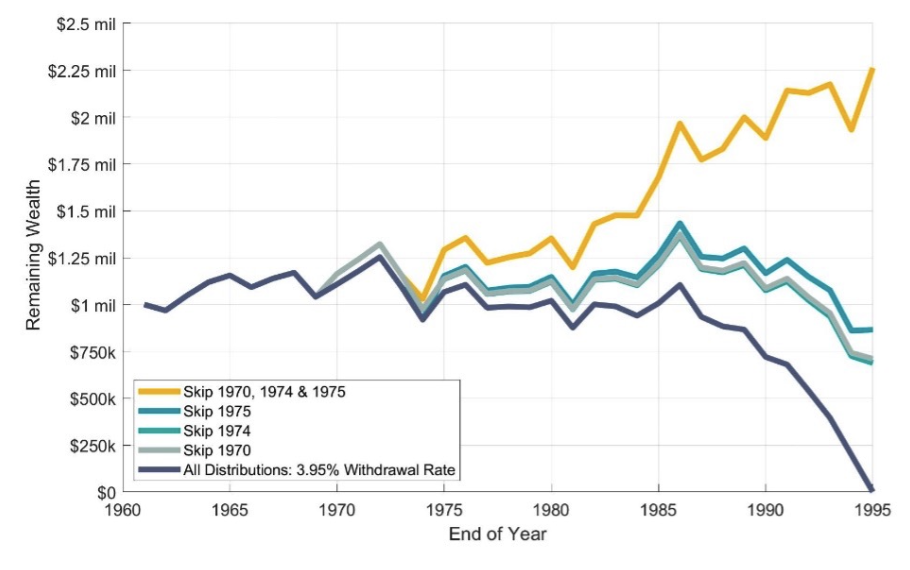

In a recent video we discussed the 4% withdrawal rule. The 4% rule is based on a study[1] that looked at historical returns for stocks and bonds and found that a diversified portfolio of stock and bonds could have supported, in most cases, a 4% withdrawal rate over a 30-year retirement. 4% refers to the withdrawal in the first year of retirement, and then that same amount, adjusted for inflation, is used for the next 29 years. What is most important about this study, is that it revealed sequence-of-return risk. It turns out that the average return of the portfolio over retirement is less important than the timing of dips in the portfolio value. Drops early in retirement are more harmful than later in retirement. As such, it can be valuable to have other assets available that are not subject to market risk to avoid or reduce withdrawals when the portfolio balance is significantly lower. We call these “buffer assets”.The example below comes from Dr. Wade Pfau[2]. It illustrates a retired couple with a $1 million portfolio invested in 60% stocks and 40% bonds. The couple began taking withdrawals in 1962 through 1995 (34 years). They withdrew 3.95% initially and adjusted for inflation each year thereafter.

[1] https://en.wikipedia.org/wiki/Trinity_study[1]

The chart is from this piece: https://www.advisorperspectives.com/articles/2022/03/03/the-intuition-for-reverse-mortgages,

Dr. Pfau also wrote a piece for Forbes on Whole Life Insurance as a buffer asset here: https://www.forbes.com/sites/wadepfau/2021/03/04/adding-whole-life-insurance-cash-value-as-a-volatility-buffer-in-retirement/?sh=6fbb47acbc1b

If they did not skip any distributions, the portfolio would have ended at $0. However, if they skipped distributions in either 1970, 1974, or 1975, they would have ended the plan with between $710,197 and $865,116. If they skipped all three years, they would have finished the plan with $2.26 million. This is just one period in history. Other periods would have smaller or larger benefits to skipping distributions. It is impossible to know going forward how much benefit there will be from skipping a distribution, since we don’t know what future returns will be. That said, we can still formulate a plan employing buffer assets to address down markets.

There are different buffer assets one could use. The most common example is cash. You could hold a certain amount of cash, perhaps enough to cover living expenses for a year or more, to use in case the market dips. The cost of this strategy is the loss of purchasing power over time, as cash generally has negative real (inflation-adjusted) returns. Alternatively, an existing whole life insurance policy can also serve as a buffer asset.

Whole life insurance policies allow you to take withdrawals or take a loan against the cash value of the policy. The loan proceeds, and withdrawals up to the policy cost basis (premiums paid in), are tax-free and can provide funds until the market recovers. The insurance company will charge interest on a loan, but the loan is not required to be paid back (the insurance company will reduce the death benefit by the loan balance). Importantly, certain whole life policies have potential for growth. Participating whole life insurance policies can pay dividends to policyowners. Dividends are not guaranteed but can be paid out in years the insurer has sufficient surplus. These dividends can buy additional paid-up insurance amounts, be held at the insurance company to generate interest, pay in cash, pay premiums, or buy one year of term insurance. Life insurance dividends are considered non-taxable return of premium, until the cost basis of the policy reaches $0 (meaning that more dividends have been received than premiums paid in). The default option for most policies is applying the dividends to buy additional paid-up units of insurance. These paid-up additions may generate future dividends, which generates a compounding effect. However, the dividend option can be changed if another option becomes more desirable, for example receiving the dividend in cash when generating income is more important than growing the cash value or death benefit of the policy. If you no longer wish to pay premiums, you can elect the “paid-up amount” surrender option, which allows you to retain the cash value and some death benefit and eliminates premiums. The critical factor for this strategy is that the policy must have enough cash value to cover your expenses while the market is down. Policies that have been in place a long time may have enough cash value to support years of living expenses, but policies that have only be in-force for a few years may not.

Having a buffer asset that is not subject to market risk can be a valuable piece of the retirement income plan. Cash is a common option and has the greatest liquidity, but it can create a drag on returns. An in-force whole life insurance policy can also serve as a buffer asset via policy loans on cash value. Keeping the policy also avoids the potential tax impact of surrendering the policy, and the proceeds will still be tax-free to your beneficiaries[1]. If you have a long in-force whole life insurance policy, you should evaluate the benefits and drawbacks of keeping the policy as part of your holistic financial plan.

[1] https://twickenham.hightoweradvisors.com/blogs/unobstructed-thoughts/estate-planning-for-generational-wealth

Zeke Anders – Planning Specialist zanders@twickenhamadvisors.com

Disclaimer

Hightower Advisors, LLC is an SEC registered investment adviser. Securities are offered through Hightower Securities, LLC member FINRA and SIPC. Hightower Advisors, LLC or any of its affiliates do not provide tax or legal advice. This material is not intended or written to provide and should not be relied upon or used as a substitute for tax or legal advice. Information contained herein does not consider an individual’s or entity’s specific circumstances or applicable governing law, which may vary from jurisdiction to jurisdiction and be subject to change. Clients are urged to consult their tax or legal advisor for related questions.